The headquarters of the BC Ministry of Health. Governments in Canada have made promises to Canadians that will require imposing much higher taxes on younger generations than those paid by older ones according to a report by a Canadian public research university. (Google Maps)

A report released by a public research university says Canada’s pay-as-you-go health care system will, in its current form, take money from younger generations to give to older ones.

The research paper, by the U of C’s School of Public Policy (SPP), notes that the taxes paid by the baby boomer generation are not enough to cover their projected future health care costs, and that the only way the federal and provincial governments will be able to keep their promises to them is to collect more taxes from future generations during their working years than the baby boomer generation paid.

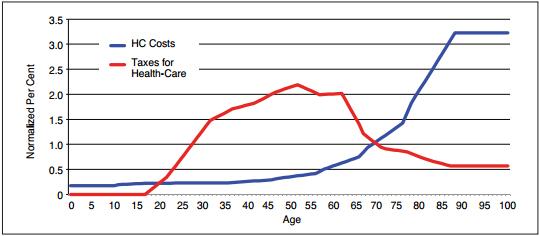

According to the report, the fundamental issue facing the current health care model is that the tax paying stage of people’s lives is different than the stage of their life when they will use health care services, as shown by this graph included in the report:

A graph showing relative health-care costs and health-care taxes by age (Can we avoid a sick fiscal future? The non-sustainability of health-care spending with an aging population, U of C School of Public Policy)

The current “pay-as-you-go” model spends all tax revenues collected from an individual on present health care needs, rather than saving it for that individual’s future health costs, resulting in intergenerational inequity in taxes paid by individuals relative to the health care they receive, in situations when a younger generation is not large enough to pay for the claims of the older generation, as is the case now with the baby boomer generation and the younger generations that follow it.

As a partial solution, the report proposes the federal and provincial governments adopt a ‘pre-funding’ model like that used for funding the Canadian Pension Plan. Taxes in the present would be increased under this set-up, and excess revenues would be invested in a government fund to be spent for the current tax paying generation’s future health care costs.

The paper further recommends that governments do more to reduce the growth in health care spending. As an example of cost-saving changes that can be made to health services delivery, it proposes shifting the site of health care delivery to the home for the elderly and those with chronic conditions, and away from acute-care hospital beds.

Political standstill

The SPP’s report is one of several released in recent years by prominent Canadian institutions that have recommended major changes to Canada’s government-run health care program.

Proposals to increase taxes for health-care or institute reforms to reduce the growth in health care spending have proven to be a political hot potato though, with the major parties unwilling to risk losing the support of the public and powerful health sector employee unions by promoting them.